Part 4: Unlocking the vault

Written by Karen Ballard, Director of Payment Integrity Solutions and Services, CGI Technologies and Solutions, Inc.

In the world of healthcare claims, payers must ensure that every dollar is spent accurately. Payment integrity programs are the guardians of this process, and a key component of a robust strategy is to shift the program to the left, moving more post-payment audits to prepayment review. This proactive approach puts more robust internal controls in place to prevent improper payments before they go out the door, generating significant savings and preventing the headaches of post-payment recovery.

But how do you quantify these prepayment savings? It's more than just a simple tally. Let's break down the key factors and introduce a formula to help you calculate the value your prepayment integrity program delivers.

Prepayment vs. post-payment: A critical distinction

First, let's understand the difference between prepayment and post-payment program models:

- Prepayment program focuses on creating internal controls to identify and prevent errors before the claim is paid. This is the ultimate goal as it avoids the need for recovery altogether. Prepayment solutions use advanced analytics, claim editing systems and policy reviews to flag questionable claims for review and adjustment.

- Post-payment program involves finding and correcting improper payments after they have been made. This is often a labor-intensive and costly process, involving chasing down providers for refunds. While a necessary part of a comprehensive program, it can create friction and is less efficient than prevention.

Therefore, the savings from a prepayment program are a form of "cost avoidance," or money that was never spent in the first place. Gaining enterprise acceptance can be challenging and may require alignment with your actuarial team. These are crucial concepts to grasp when calculating savings dollars and, ultimately, return on investment (ROI).

The variables in the calculation

To accurately calculate prepayment savings, you need to consider a few key variables:

- Total members: This is the count of active members as of a specific date. Due to active member fluctuation throughout the year, using “member months” (a count of all active members by month for twelve months) is recommended. The count can be done on any date in the month, provided it is consistent. Using the first of the month is recommended.

- Total claims count: This is 100% of all paid claims volume. Payment integrity is typically measured with medical claims, but if payment activities are completed on specialty or pharmacy claims, those can also be included. Note that only the most recent iteration of the claim should be counted for claims with adjustments.

- Total claims spend: This is the total amount of money processed through your claims system over a specific period; it's the universe of data you're working with.

- Prepayment avoidance (savings): This is the amount of overpayment prevented on a claim. Depending on the payment integrity program, this can be the difference between what the claim allowed before and after the prepayment review or a factor of the paid amount as directed by the actuarial team. Typically, a factor is used for coordination of benefits (COB), subrogation and provider education, where it is more difficult to measure actual savings (this can be used when a service billed doesn’t have an actual allowed amount or the original allowed amount isn’t captured).

- Prepayment avoidance (savings) rate: Also referred to as “savings as a percent of medical expense”. This is the percentage of your total claims spend identified and prevented from being improperly paid. This rate is determined by the effectiveness of your prepayment solutions, including automated edits, manual reviews and advanced analytics.

- Cost of the prepayment program: This includes all costs associated with running your prepayment integrity program. This could include:

- Technology and software costs: The cost of the claims editing system, analytics tools and other technology platforms.

- Personnel costs: The salaries and benefits of the staff managing the program, reviewing flagged claims and handling provider communication.

- Overhead: Any other administrative costs associated with the program.

The savings calculation formula

Savings calculations can be for overall program savings or broken down by payment integrity program, timing, line of business, geography or other categorization relevant to your organization. Here, we will focus on total program savings for prepay activities.

Formulas:

- Savings as a percent of medical expense = prepayment avoidance (savings)/total claims spend

- Per member per month (PMPM) savings = total members/prepayment avoidance (savings)

- Prepay ROI = total claims spend × prepayment avoidance (savings) rate) − cost of prepayment program

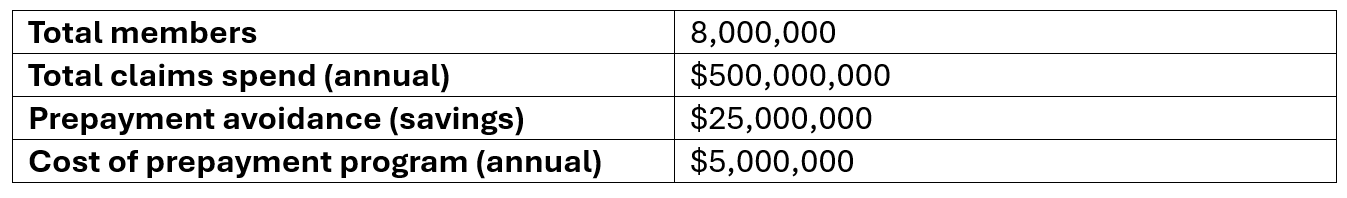

For demonstrative purposes, here is a hypothetical example:

Using the formula:

Savings as a percent of medical expense: $25,000,000/$500,000,000 = 5%

Per member per month (PMPM) savings: $25,000,000/8,000,000 = $3.19

Prepay ROI: ($25,000,000-$5,000,000)/$5,000,000×100=410%

This means, on average $0.05 in savings is found for every dollar spent on a claim, and for every dollar invested in the program, you are getting $4.10 back in savings. For a more accurate picture, it is recommended to repeat these calculations at the payment integrity activity level (i.e., claim edits, data mining, itemized bill review, DRG review) as the savings as a percent of medical expense may widely vary when comparing activities. This level will provide more accurate forecasting when adding a new edit or concept to your rules engine.

Beyond the numbers: The intangible benefits

While the financials are crucial for demonstrating value, it's important to remember that a successful prepayment integrity program delivers more than just monetary savings. Other benefits include:

- Reduced provider abrasion: By catching errors before payment, you reduce the need for retroactive adjustments and recoupment, which can strain relationships with providers.

- Improved member experience: A well-run program ensures members are not overbilled for services or subjected to unnecessary out-of-pocket costs.

- Enhanced compliance: Prepayment reviews help ensure claims adhere to all relevant regulations and policies, reducing the risk of penalties.

- Data-driven insights: The data collected from prepayment reviews can be used to identify root causes of errors, allowing you to make strategic adjustments to your policies and processes to prevent them from happening in the future.

Calculating prepayment savings is essential for any payer or administrator looking to prove the value of their payment integrity program. By focusing on cost avoidance and understanding the key variables, you can demonstrate how a proactive approach is a financial win and a strategic advantage.

This approach works when you’re messaging the success of your prepayment program within your organization, but what is needed to message the success to your customers? Industry payment integrity standards are key to external messaging (i.e., demonstrating value to your customers) and understanding your payment integrity program performance (i.e., demonstrating value to leadership and supporting exploration of new opportunites).

Supported by Kisaco Research, an independent research firm, I co-lead an industry-wide workgroup that proposes adopting standard metric definitions and calculations while supporting payment integrity teams across the U.S.

To learn more about supporting the effort to standardize payment integrity metrics, join our LinkedIn group or contact us today: [email protected].